Get a straight yes or no before you apply

That's one good thing

No impact to your credit score

Do it quicker in your online account

View statements. Make payments. Check transactions. And lots more. Sign in now

Find the right card for you

See if you're eligible today, without hurting your credit score.

- Start with a credit limit of at least £200

(your max depends on application) - Build your credit score over time

- Up to two optional credit increases per year, if eligible

Just remember, not using your card responsibly could hurt your credit score. This could mean you're less likely to be offered a credit limit increase.

34.9% APR

Representative variable

Apply online today

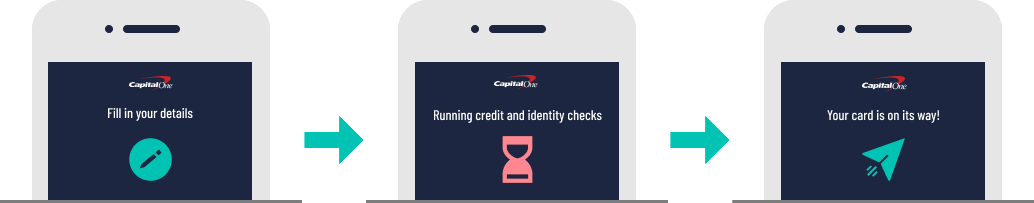

1

Do a QuickCheck

without affecting your credit score

2

Get an answer

in 60 seconds or less

3

Apply (if you get a yes)

and your card arrives 7 to 10 days later

Do it in the app

On a train. Over breakfast. From the sofa. Take care of your finances when it suits you.

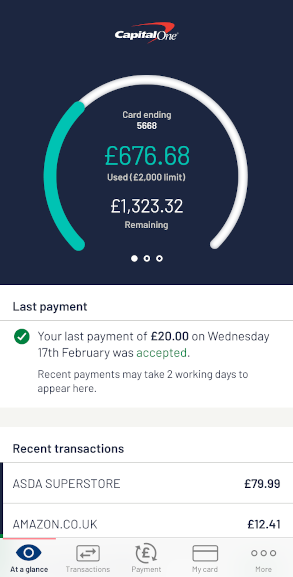

A screen showing the At A Glance Page from the mobile app

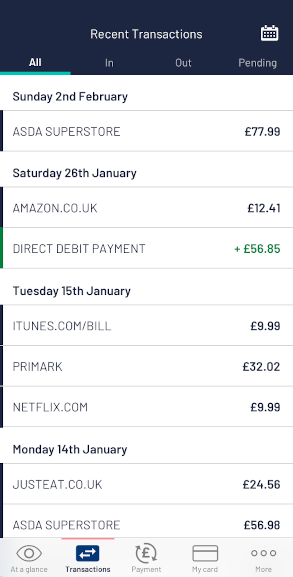

A screen showing the Transactions Page from the mobile app

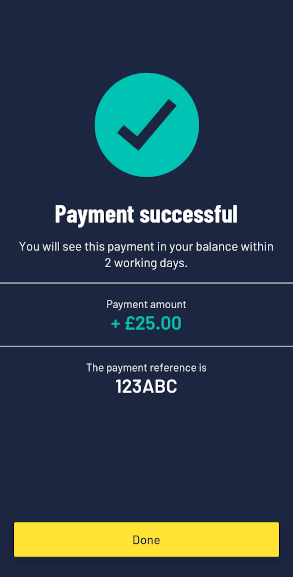

A screen showing the Payments Page from the mobile app

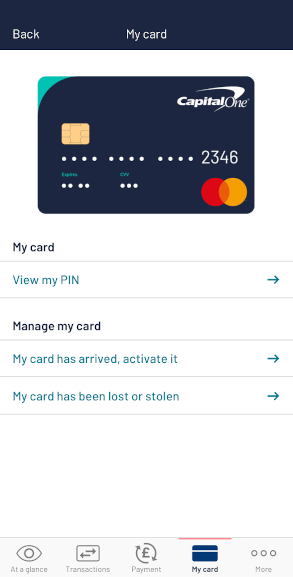

A screen showing the My Card Page from the mobile app

It's easy in the app

- See your balance and transactions in real time

- Keep an eye on any spending with notifications

- Lock or unlock your card any time

- Check your PIN, if it slips your mind