Image credit: Pexels

Credit Building Report: What do credit card holders really know about credit scores?

13 min read

Credit scoresopens in a new tab can be a good indicator of people's financial health, influencing everything from taking out a loan to getting a more favourable interest rate. Yet, for many people in the UK, what is actually behind a good or bad credit score is an area clouded by confusion.

To better assess people's understanding of credit scores, we surveyed 2,000 credit cardopens in a new tab holders in the UK to identify their level of credit confidence and awareness of the key factors that influence their scores.

Our findings revealed that, despite the fact that building their credit scoreopens in a new tab was respondents' main reason for taking out their first credit card (cited by 32% of them), many respondents struggled to accurately identify the factors that can affect their score.

Capital One UK wants to help people succeed with credit, so we've dived into our survey findings to provide further guidance, dispel common myths and share actionable tips aimed at those looking to boost their credit healthopens in a new tab.

Key findings

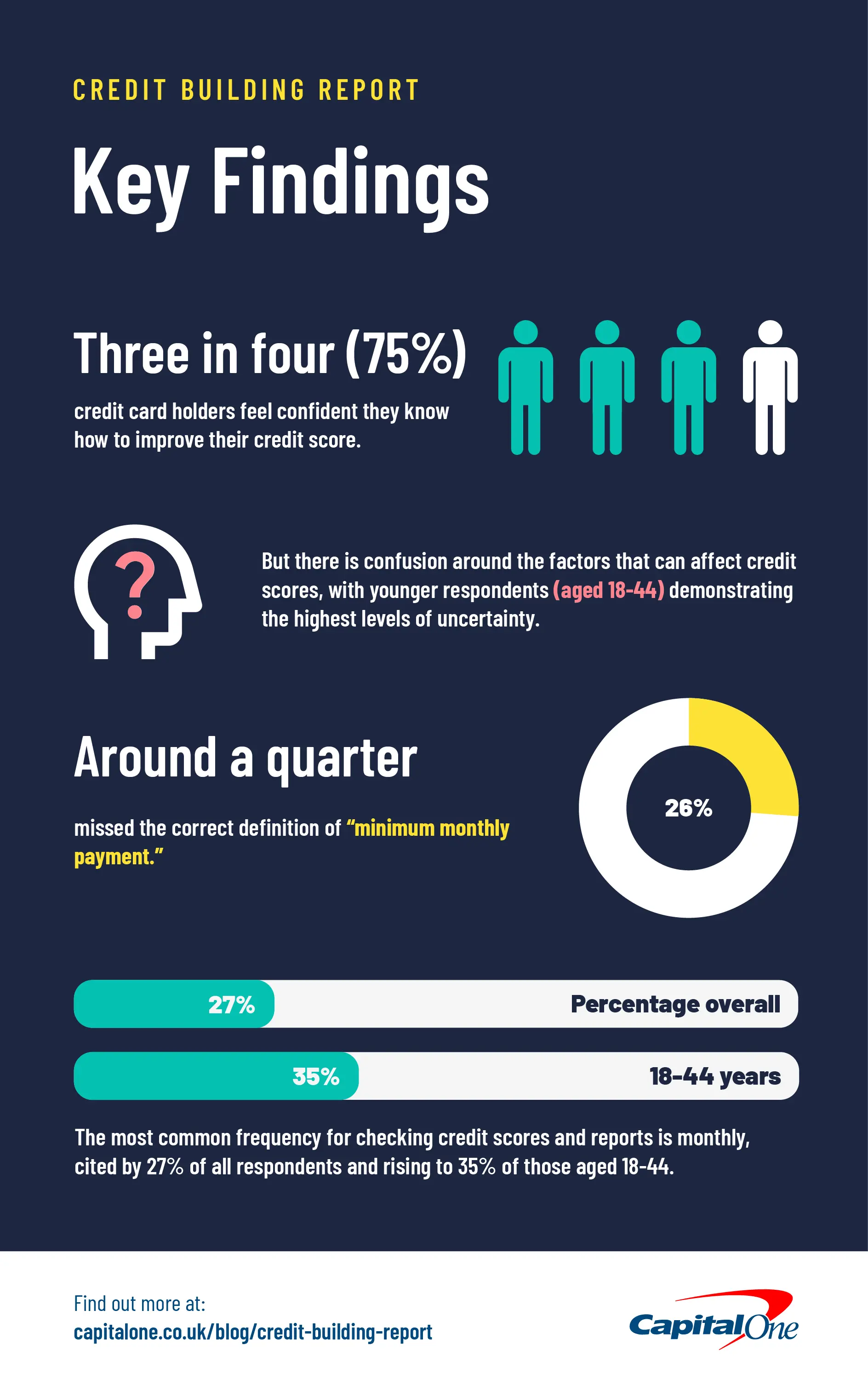

- High credit confidence: Three in four (75%) credit card holders say they feel confident that they know how to improve their credit score.

- Factor misunderstandings: There is confusion around the factors that can affect credit scores, with younger respondents (aged 18-44) demonstrating the highest levels of uncertainty.

- Payment pitfalls: Around a quarter of credit card holders (26%) missed the correct definition of a 'minimum monthly payment', leaving them at risk of financial mishaps.

- Monthly monitoring: The most common frequency for checking credit scores and reports is monthly, cited by 27% of all respondents and rising to 35% of those aged 18-44.

Who is actively trying to improve their credit score?

Overall, 31% of survey respondents claim they are actively trying to improve their credit score. This figure is highest among younger age groups and decreases steadily with age.

Are you currently actively trying to improve your credit score?

| Demographic | Yes | No |

|---|---|---|

| Overall | 31% | 69% |

| 18-24 year olds | 79% | 21% |

| 25-34 year olds | 69% | 31% |

| 35-44 year olds | 48% | 52% |

| 45-54 year olds | 22% | 78% |

| 55-64 year olds | 12% | 88% |

| 65+ year olds | 6% | 94% |

When we focus on the age group that is more likely at the start of their independent financial journeys (18-44 year olds), that figure rises to 58% compared to only 13% of those aged 45 and over.

| Demographic | Yes | No |

|---|---|---|

| 18-44 year olds | 58% | 42% |

| 45+ year olds | 13% | 87% |

Throughout this report, we will focus on comparing the results for the total sample with those aged 18-44, to uncover more about this credit building demographic.

As a good score could make it easier to borrow, understanding what shapes credit scores will help people focus on the right areas.

Credit card holders appear confident about how to improve their credit score

How confident are you that you know how to improve your credit score?

| % overall | % of 18-44 year olds | |

|---|---|---|

| Very confident | 19% | 26% |

| Somewhat confident | 56% | 60% |

| Overall Confident | 75% | 87% |

| Not very confident | 18% | 12% |

| Not at all confident | 7% | 1% |

| Overall Not Confident | 25% | 13% |

*Percentages may not sum due to rounding

Three in four are confident they know how to improve their credit score

The majority of those surveyed feel confident that they know how to improve their credit score (75%). Confidence peaks among 18-44 year olds, with 87% saying they're confident overall and more than one in four (26%) describing themselves as very confident.

Despite this confidence, there is a lot of confusion around the factors that can actually affect credit scores

When respondents were asked to demonstrate their knowledge of credit scores and how to improve them, a clear gap emerged between their confidence levels and understanding.

When shown a list of factors that can affect their credit score, 63% of respondents correctly identified making payments on existing credit as an influencing factor, while each of the remaining factors was recognised by broadly half or fewer of the participants.

Although 87% of 18-44 year olds in our survey said they were confident that they know how to improve their score, when presented with a list of factors that can impact their credit scoreopens in a new tab, they were less likely than the overall average to identify them correctly.

Which of the following do you think might influence your credit score?

| Rank | Factors that can affect credit scores | % overall | % of 18-44 year olds |

|---|---|---|---|

| 1 | Making payments on existing credit | 63% | 51% |

| 2 | Credit limit usage | 55% | 50% |

| 3 | Opening new credit or debit accounts | 53% | 43% |

| 4 | Paying bills and utilities | 52% | 45% |

| 5 | Being on the electoral register | 52% | 41% |

| 6 | Buy now, pay later accounts | 49% | 41% |

| 7 | Having a payday loan | 49% | 41% |

| 8 | Closing credit or debit accounts | 40% | 38% |

| 9 | Joint accounts | 29% | 26% |

Only three in 10 believe joint accounts can affect credit scores

Joint accounts create a financial link between the people involved, which means if the account is managed well, it can positively affect the credit scores of everyone attached to it, just as issues like missed or late payments can hurt everyone's scores. Yet only 29% of survey respondents believe joint accounts can affect their score, lowering to 26% among 18–44 year olds. Joint accounts aren't limited to bank accounts; they can also include other accounts where multiple people are named, like an electricity or phone bill. Because of the financial link that's created, it's a good idea to check your own credit scoreopens in a new tab and be mindful of the shared responsibility that comes with joint accounts.

Less than half of credit card holders believe that buy now, pay later influences scores

There seems to be some confusion around newer forms of borrowing, with less than half (49%) of respondents believing buy now, pay later accounts (BNPL) can affect their credit score. Among 18–44 year olds, this reduces to 41%, and is even lower for the 18-24 age range (32%). However, as BNPL is simply another form of credit, if you make regular, on-time payments this can positively impact your score, while missed payments can negatively affect it.

To find out more about how these factors and the others listed in our table can affect your credit score, visit our page: What can affect your credit scoreopens in a new tab.

Many mistakenly believe in factors that don't affect their credit score

If you're trying to build your credit score, it's important to understand the factors that aren't taken into consideration so you can focus your energy on the right areas. The table below shows that even among credit card holders, confusion is common, with many incorrectly believing that a range of irrelevant factors affect their credit score.

Which of the following do you think might influence your credit score?

| Rank | Factors that don't affect credit scores | % overall | % of 18-44 year olds |

|---|---|---|---|

| 1 | Income | 44% | 36% |

| 2 | Eligibility check for a credit card | 31% | 31% |

| 3 | Your job | 23% | 19% |

| 4= | Marital status | 21% | 17% |

| 4= | Where you live | 21% | 16% |

| 6 | Student loan | 21% | 16% |

| 7 | Checking credit score | 15% | 17% |

| 8 | Researching credit products | 14% | 12% |

| 9 | Comparing credit cards | 11% | 12% |

Income does not directly affect your credit score

Income was most likely to be incorrectly chosen as an influencing factor by 44% of respondents, and was also the top answer among 18-44 year olds (36%). In reality, how much you earn has no bearing on your credit score, though it may affect your ability to access certain financial products.

'Soft credit checks / searches' don't affect your score

A further 31% (among our total sample and among 18-44 year olds) incorrectly believed that going through an eligibility check for a credit card affects your score, but this actually has no impact. Eligibility checkers, like Capital One UK's free QuickCheckopens in a new tab tool, perform a 'soft credit check' which doesn't affect your score. Similarly, although 15% of people in our survey (and 17% of those aged 18-44) believed that checking their credit score would affect it, this is also done through a 'soft credit check', which has no impact on your score. You can use Capital One UK's CreditWiseopens in a new tab tool to find out your score and get a full report for free.

To find out more about these irrelevant factors and the others listed in our table, visit our article: Credit score mythsopens in a new tab.

Are 18-44 year olds credit savvy or credit confused?

The table above shows 18-44 year olds were less likely than average to select the irrelevant factors we listed - the same pattern they displayed when presented with the factors that can affect their credit score. This tendency to underselect the options presented to them suggests that, despite them claiming to have higher than average confidence levels when it comes to improving their credit scores, they actually have less certainty and/or conviction around the factors that can influence their score than older age groups.

Our helpful guide: Credit Scores Explainedopens in a new tab is a really good starting point for anyone who is new to credit or looking to build their score.

Top tips for improving your credit score

Our survey shows that even those who own a credit card aren't sure what they need to focus on if they're looking to improve their credit score. Knowing where to start is half the battle, so here are some top tips from Capital One UK for anyone hoping to get on the right track.

1. Check your credit score and report to see where you stand, then monitor regularly

To make a start on improving your credit score, you need to know where you currently stand. Capital One UK's free online tool CreditWiseopens in a new tab provides a quick and easy way to check both your credit score and report. Your score will help you understand how lenders see you and your report will give you an idea of what you can change. You then need to commit to checking your score and report regularly so you can monitor the impact of your financial decisions and track your progress.

Our survey revealed that monthly is the most popular frequency for checking credit scores and reports among credit card holders, which rises to 35% among 18-44 year olds. If you're actively working to improve a bad credit scoreopens in a new tab or planning to apply for new credit, it's a good idea to check even more frequently.

Quite worryingly, almost a quarter (23%) of credit card holders admitted they never check, which means errors on their report or low scores that could affect their ability to borrow could go unnoticed.

How often, if ever, do you check your credit score / report?

| Frequency | % overall | % of 18-44 year olds |

|---|---|---|

| Daily | 3% | 7% |

| Weekly | 12% | 20% |

| Monthly | 27% | 35% |

| At least once every 6 months | 17% | 18% |

| Once a year | 6% | 7% |

| Less than once a year | 11% | 7% |

| Never | 23% | 6% |

2. Fix any errors on your credit report

Errors on your credit report aren't unheard of and, if left unchecked, could damage your credit score. They can be something as small as a typo in your address or a debt that has been paid off but still shows as outstanding. Even a small error could be enough to affect your score and reduce your credit options.

Our survey found that 14% of respondents have discovered an error on their report, with this increasing to over one in five (22%) 25-34 year olds. A further 14% of respondents admit that they don't know how to check if their report is correct.

If you spot a mistake, simply ask the credit reference agency to change it - if it's a mistake, then it's their responsibility to correct it. If you're regularly checking your reportopens in a new tab, you can make sure it's error-free and know that lenders have an accurate picture of your financial health.

3. Always pay at least the minimum monthly payment

If you've taken out a credit card, each month you'll receive a statement summarising the purchases you've made and what you owe. You'll need to repay at least the 'minimum monthly payment' (which is the lowest amount your credit card provider can accept as payment against your credit card balance) each month to avoid a fee and start building your credit score. If you miss a payment you could damage your credit score, so setting up a monthly Direct Debitopens in a new tab is a good way to stay on top of your repayments. It's a good idea to pay your balance in full each month if you can, so you can avoid paying interest on what you owe.

Despite our survey base being credit card holders, over a quarter (26%) weren't able to correctly identify the definition of a minimum monthly payment, which rose to one third (33%) of 18-44 year olds. To truly take charge of your financial health, it's really important to understand the terminology around credit cards, so we've broken down the main terms you'll encounter on your credit card statement in our Credit Jargon pageopens in a new tab.

Find out more about your credit score

- Credit scores explainedopens in a new tab - Your guide to your credit score

- What can affect your credit scoreopens in a new tab - Stay on top of what could impact your score

- How to build your credit score with a credit cardopens in a new tab - Understand how you can use a credit card to improve your credit score

- Credit score mythsopens in a new tab - Debunking common credit score myths to help you focus on what matters

Methodology

Capital One UK commissioned OnePoll to survey 2,000 UK adults (18+) who own a credit card to identify the level of credit confidence and understanding. This included questions about key factors that influence scores, how often they check their scores, their understanding of credit card terminology, and more.